System administrator

System Maintenance

Scheduled Messages

Modify message

Create message

Scheduled messages

Message frequency options

Report selection

Email settings and troubleshooting

Send one-time message

T&A Web

UK & IRE time change instructions

T&A instructions for UK & IRE Time Change - March 2025

FES Instructions for UK & IRE Summer Time Change – March 2025

Dashboard Maintenance

Profile maintenance

Tab maintenance

Dashboard maintenance

Reports widget

Widget maintenance

Widget public URLs

Themes and Dashboard

Modifying and deleting a created Theme

Dashboard background

Creating a Theme

Custom login logos

Active Themes

Progress Indicator

Theme

Calendar Maintenance

Create calendar

Calendar profiles

Calendar data types page

Calendar maintenance

Creating a Calendar data type

Payslip Management

Kiosk

Kiosk details

Kiosk Configuration

Modify action

Kiosk site planner

Kiosk log

Modify Kiosk preferences

Preparing to install Kiosk

Terminal Site Planner

Deactivate and Reactivate the terminal webpage

Upgrade Terminal Firmware on 900 series or Access Control Unit via Web Service

Terminal upgrades

Terminal Site Planner

Poller preferences

Terminal Actions

Job Scheduler

Poller log

SAML Authentication

Licensing

Licensing upload errors

Upload T&A 8 License Instructions

Temporary Licence

Version Number Mismatch

Licensing

Request a Licence

Upload a Licence

Employee License

Messages Received

Enroller

Language Maintenance

Profile language

Importing and Exporting phrases

T&A Error phrases

Language maintenance

Culture maintenance

Advanced T&A Products Minimum IT Specifications

Configuring T&A for use with Microsoft Exchange Online

Support Knowledge Base

Clearing Anomalies - Start a New Period End

T&A 8 licence expiry and renewal

Adding and changing Users in WINTMS

Full Rights for New User

AutoID Badge designer

Delete a Finger Template

Need to Create a Report With a Date Prompt

T&A - European Working Time Directive Features

How to Change the Name Displayed on the Terminal

Client Install instructions

How to Download an Employee to the Terminals

Create New User

Changing the IP Address on a Mitrefinch 900 Series clock or Access control unit.

Employee in TMS but not in HR Manager

GPS clocking location from a mobile phone

Report That Shows if the Employee Has a Photo

Obtaining "500 internal server error" details

Spring Time Change - North America

How to Unlock a User

Support is Evolving

Data Assurance Module - Identifying and preventing the accidental deletion of data (TMS versions 8.33.0.0 and below)

.NET Framework 4.8 for T&A (version 8.35.0+)

'Use Only Once' Checkbox on Book Absence Screen

Changing the OT Threshold for OT Hours Calculation

Poller Keeps Going Down

Help with Australian ADP Export Coding

The Basics

Change Culture

Supervisor Basic Operations

Apply assumed clocks

Changes to hierarchical Security

Adding an additional day of credit

Invalid Login

T&A Entitlement Year End Procedure - Hosted by OneAdvanced

T&A Entitlement Year End Procedure - On premise

Logging in and out as an Employee

Apache Log4j CVE-2021-44228 "Log4Shell" vulnerability

Employee basic operations

TMS Apps

Logging in: the Help button

Adding a keyed absence

Logging in as a Supervisor

Error tGlb.GetPkg

General navigation

COVID 19 - How to manage staff working from home

SAML Authentication in TMS 7

Auto-Rostering - User Admin/Supervisors

Auto-Rostering overview

What data is synced from Time & Attendance to Auto-Rostering?

Schedule Setup

Manage Schedules

Solving a Schedule

Schedule Approval

Employee and User Management

Reporting

Employee Confirmations

Dashboards

Frequently asked questions - Auto-Rostering

T&A Data share

Identity by OneAdvanced

Identity FAQs

Introduction to Identity

Choose your authentication method

Managing multiple access needs

Employees without email addresses

What do I need to know?

Managing Identity

Setting up OneAdvanced Identity for your organisation

Step 1 - Requesting your OneAdvanced Identity Service

Step 2 - Configuring your OneAdvanced Identity Organisation

Step 3 - Identity onboarding in Time and Attendance

Step 4 - Perform the Identity onboarding process

Step 5 - Inform employees and managers they can login using Identity

Step 6 - Employees and managers successfully login to Time and Attendance through Identity.

Leavers, rejoiners and deleting employees – the impact on Identity.

Onsite Report – OneAdvanced’s Liability Statement

RD Web User Guide: Duo Authentication Process Guide

Supervisor

The Supervisor View

Employee <undefined>

The Supervisor dashboard

Supervisor toolbar

Selecting Employees

Selection options

Employee and Group functions as a Supervisor

Change Supervisor password

Supervisor Functions

Clocking In and Out

Clocking in and out as a Supervisor

Clocking TAS

Location mapping for Clockings

SMS Clocking with Esendex

Make a T&A clocking

Absences

Employee Security

Invalid Credentials

Locking and unlocking an employee's account

Changing an Employee's PIN

Self service password reset

Password Expiry for Employees

Employee passwords

Timesheets

Payslip Management

Calendars

Restart Employee

Employee Maintenance

Availability

Supervisor Group Functions

On-site List

On-site list profile maintenance

Maintain On-site list

On-site list (Supervisor)

Maintain current watches

Modify On-site list

On-site system preferences

On-site list options

Diary

Group Planner

Rosters

Copy periods action

Create named roster action

Group planner preferences

Shift actions

Shift Lock To

Create personal rosters action

Group planner

Group Clock Card

Group Skills

Letters

Group Absence Profile

Find Cover

Job Planner

Group Messages

Hours Approval

Mass Change

Anomalies

Editing work records to correct Anomalies

Authorising in the Anomalies page

Review Anomalies as Supervisor

Group Badge List

Requests List

Adding Additional Payments

Budgeting

Reports

Reports overview

Supervisor Access to Reports

Default Reports

Report profiles

Creating a New Report

Adding additional columns to a Report

Report tasks

Reports employee selection

Bradford factor report

Running a Report

WinTMS User Guide

Employee

The Employee Dashboard

Employee Functions

Requests

Visitor Booking

On-site List

Employee Planner

Calendars

Clock Card

Clock card

Work record

Clockings Panel

Premium bands panel

Hours bands panel

Additional payments panel

Worked hours panel

Check Anomalies as Employee

Clocking T&A

Actual Lateness

Recent clockings

Employee Details

Timesheets

Reports

Payslips

Group Absence Profile

Availability

Availability

Availability details

Add Availability

Copy Availability

Delete availability

Availability errors

Absences

Employee Documents

Planned Shifts

Employee Messages

Skills

Employee Security

Auto-Rostering - Employees

Release Notes

Upgrading Time and Attendance

Release Reports

T&A 8.48.0.0 General Release - 27th February 2026

8.48 upgrade for P60 and Payroll End End - what you need to know

T&A 8.47.0.1 Patch Release - 20th February 2026

T&A 8.47.0.0 General Release - 9th January 2026

OneAdvanced mobile app

T&A 8.46.2.0 General Release - 27th November 2025

T&A 8.46.1.0 General Release - 30th October 2025

T&A 8.46.0.0 General Release - 15th October 2025

T&A 8.45.0.1 General Release - 21st August 2025

T&A 8.45 General Release - 9th July 2025

OneAdvanced People mobile app 1.3 release - 4th June 2025

T&A 8.44.0.0 General Release - 29th May 2025

OneAdvanced People mobile app launch - 20th March 2025

T&A 8.43.0.0 Controlled Release - 12th March 2025

T&A 8.42.0.0 General Release - 5th February 2025

T&A 8.41.2.0 General Release - 13th December 2024

T&A 8.41.1.0 General Release - 4th December 2024

T&A 8.41.0.0 General Release - 6th November 2024

T&A 8.39.0.1 Controlled Release - 17th July 2024

T&A 8.38.5.2 Controlled Release - 1st May 2024

T&A 8.39.0.0 Controlled Release - 19th June 2024

T&A 8.38.5.1 General Release - 16th February 2024

T&A 8.38.5.0 Controlled Release - 29th November 2023

T&A 8.38.4.1 Controlled Release - 2nd November 2023

T&A 8.38.4.0 Controlled Release - 1st September 2023

T&A 8.38.3.0 Controlled Release - 27th July 2023

T&A 8.38.1.0 Controlled Release - 2nd May 2023

T&A 8.38.0.0 Controlled Release - 20th March 2023

T&A 8.38.2.0 Controlled Release - 9th June 2023

T&A 8.37.4.2 General Release - 17th February 2023

T&A 8.37.4.0 Controlled Release - 20th January 2023

T&A 8.37.3.0 Controlled Release - 2nd December 2022

T&A 8.37.2.0 Controlled Release - 21st October 2022

T&A 8.37.1.0 Controlled Release - 1st September 2022

T&A 8.37.0.0 Controlled Release - 22nd July 2022

T&A 8.37.0.1 General Release - 23rd August 2022

T&A 8.36.10 Controlled Release - 9th June 2022

T&A 8.36.9.0 Controlled Release - 28th April 2022

T&A 8.36.8.1 General Release - 28th March 2022

T&A 8.36.7.1 General Release - 17th February 2022

T&A 8.36.7.0 General Release - 3rd February 2022

T&A 8.36.6.0 General Release - 16th December 2021

Got an idea???????

OneAdvanced Mobile App

- All categories

- System administrator

- The Basics

- T&A Entitlement Year End Procedure - On premise

T&A Entitlement Year End Procedure - On premise

Updated

by Karishma

Entitlement Year End Procedure for T&A - On premise

Introduction

For customers with Time & Attendance as an On-Premise solution, this document explains how to perform the Entitlement Year-End Procedure. This allows you to reset the entitlements for all employees to the start of a new year. This procedure should be performed after each entitlement reaches the end of its specified year. Any entitlement to be carried over will then be calculated automatically.

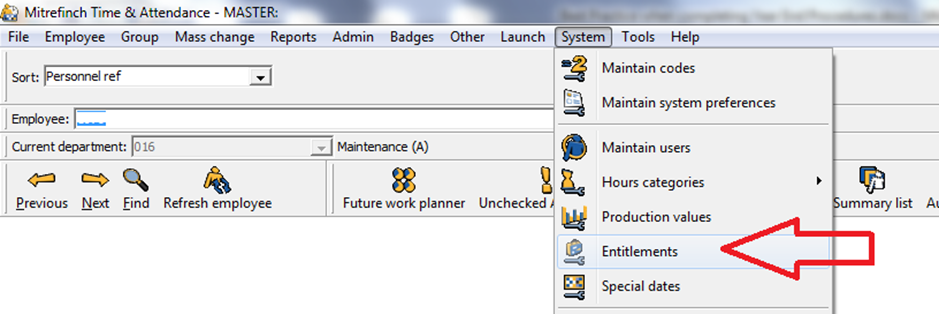

The year start and year end may vary for different entitlements. For example, the holiday entitlement year may run from January to December, whereas the training entitlements might run from April to October. Your current Start and End Dates can be confirmed by clicking on the menu: System > Entitlements.

If you use individual entitlement years (i.e. different year start and end dates for each employee), you should still perform this procedure once a year so that the default settings remain correct for any employees who do not have individual entitlement years set up.

Please note you will also need to carry out this procedure separately for each entitlement type you have defined (even if the year ends on the same date) ie - Toil

Preparation for the Year End Procedure:

Firstly confirm that all changes to previous year’s entitlements has taken place. This means that any annual leave entries should be entered or populated for the previous year prior to the year end taking place. Otherwise the carry over figure for employee’s will be incorrect.

Please note: Generic Admin accounts won't have access to Sysgen, it would need to be the master account or a FULL ACCESS admin account.

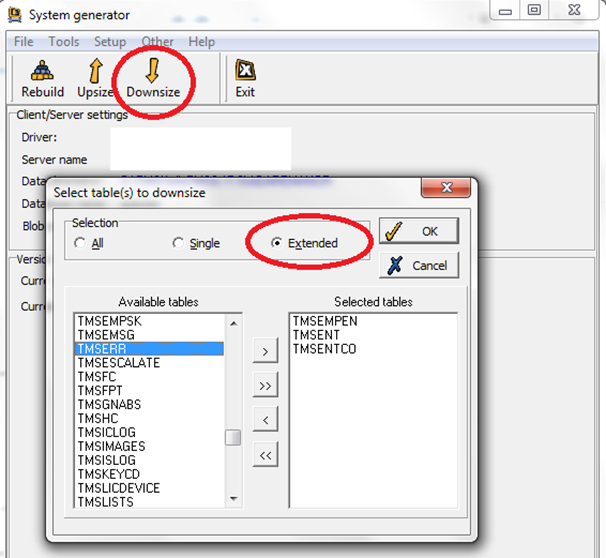

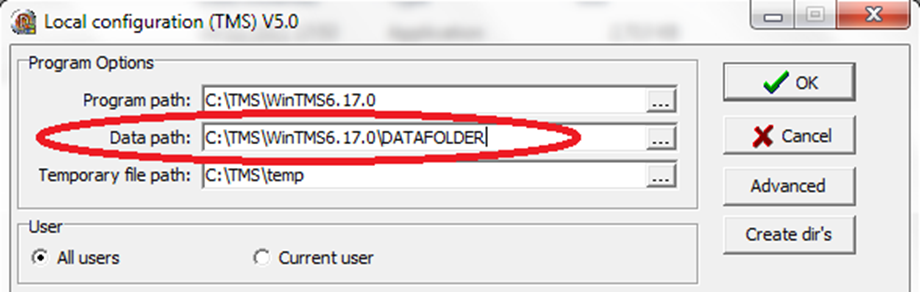

Now that you have a local copy of the three tables in your data folder, you need to copy them into a new folder for safe-keeping. Navigate to the data folder for T&A, it’s location can be confirmed by running LOCALCFG.exe from the WINTMS folder.

Once in this location, create a new folder to store the backup of the entitlements in and then copy them into the folder. This is done because any future downsizes of data done in TMS would overwrite the table copies again. Since we have them in a new folder they will be safe.

Watch the video tutorial on Step 1 - BackUp:

It is recommended that you run the ‘Entitlement Report’ (available from the menu: Reports > Custom Reports) to check that the relevant employees have taken their entitlement for the previous year and also save a copy of the report for future reference.

Watch the video tutorial on Step 2 - Run Entitlement Report:

How to perform the Year End Procedure:

Next you can complete the Year End procedure in T&A. To do this go to System -> Entitlements in WINTMS.

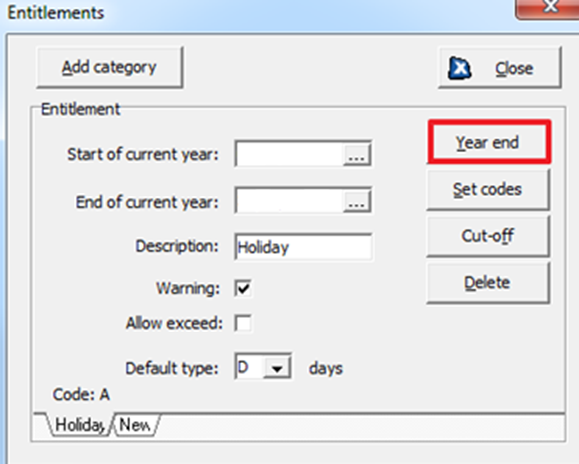

Select the required Entitlement by clicking the appropriate tab at the base of the form then click the Year end button. Please note you can ONLY perform this after the date shown for ‘End of current year’.

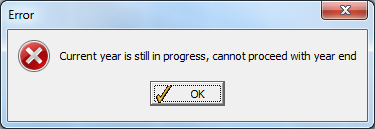

If you attempt to perform the Year End procedure prior to the end date, the following window will open stating that the current year is still in progress. You will need to wait until after the end date before this procedure can be completed. Click OK then Close to return to the main T&A screen.

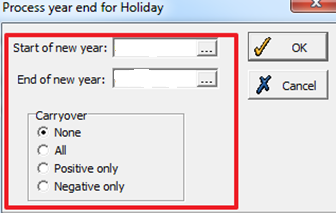

A Process year end window will open. The Start and End of New Year fields are populated automatically by T&A based on the dates of the previous year. If you need to alter these dates you can either enter the new dates directly into the fields or use the calendar. Please ensure you check the start and end dates are correct prior to proceeding.

You must then select one of the four Carryover options:

- Select None if you do not wish any entitlement to be carried over to the New Year.

- Select All if you wish to carry over all unallocated entitlement i.e. both positive and negative.

- Select Positive only to carry over any entitlement still owing from the previous year i.e. not taken by an employee.

- Select Negative only to carry over any NEGATIVE entitlement i.e. entitlement that is to be taken away from the employee.

Once you have selected a Carryover option, click ‘OK’ to proceed and perform the Year End procedure for the Entitlement. Alternatively, click Cancel to return to the previous entitlement screen.

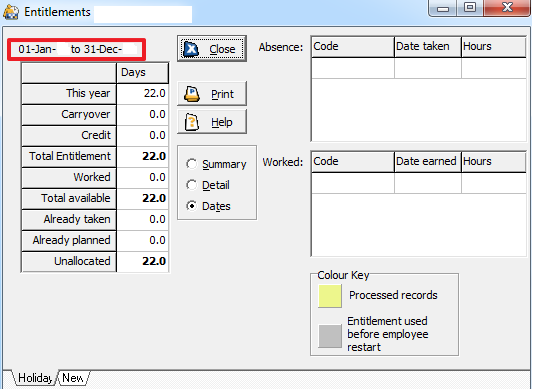

T&A will automatically adjust the associated Start and End dates on the entitlement form and any ‘This Year’, ‘Carryover’ and ‘Credit’ values. You can verify that this has been performed by checking that the date range has changed to the new year within the Employee Entitlements screen via the Employee menu: Employee > Entitlements

- For any other entitlements requiring a Year End, repeat from step 2 and select the appropriate entitlement tab located at the bottom of the Entitlements window.

- If you are also using Web T&A or the Silverlight module of T&A, then your IIS will need to be reset by your IT Department to read these changes. To do this, type IISRESET at a command prompt on the web server. Please be aware that this will reset the connections of all people connected to websites on this server and force them to log in again.

Watch the video tutorial on Step 3 - Complete Year End Process:

Individual Entitlement Year (Follow ONLY IF applicable to your organisation):

If you use individual entitlement years (i.e. different year start and end dates for each employee), you should still perform this procedure once a year so that the default settings remain correct for any employees who do not have individual entitlement years set up.

Watch the video tutorial on Step 4 - Run Individual Year End Process:

Further Information:

As stated in the introduction section, once this procedure has been performed it cannot be reversed within T&A. Should you need to reverse the procedure then please make sure to backup the 3 TMS Entitlement Tables as instructed above.

Should you require any assistance or have any questions about the instructions then please contact T&A Support by raising a ticket via our support portal website by clicking here. Alternatively, please call 0330 726 0090.